Powering Smarter

Possibilities

Our Smart Technology was developed with one clear goal: to help provide protection against bear market losses. This common sense approach to portfolio risk management powers all our Smart Solutions.

How it Works

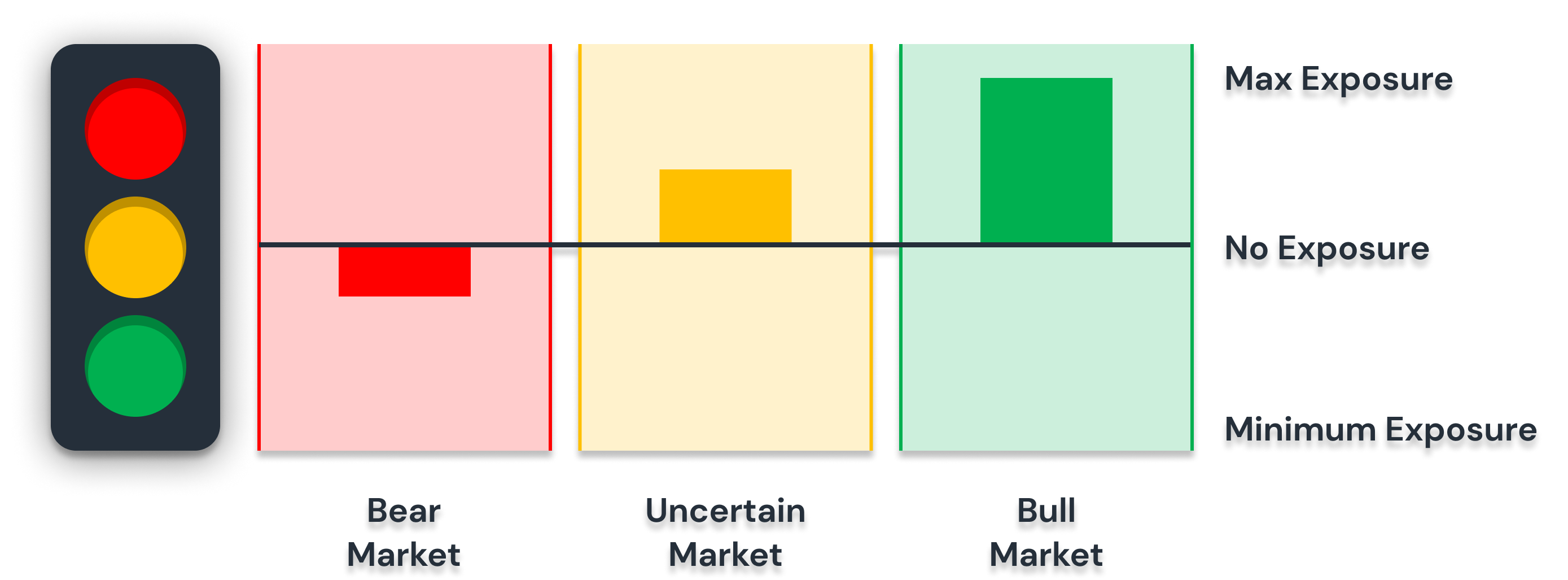

Our proprietary technology is designed to accurately measure market risk, which it classifies into three risk-environments: bull, uncertain or bear market. Our Smart Technology decreases portfolio risk as market risk increases.

Smart Technology in Action

Monitor Market Risk

Uses two price-based signals to accurately monitor the current market risk environment:

- Price Momentum Indicator (monitors market price movement)

- Price Volatility Indicator (monitors realized market volatility)

Measure Market Risk

Seeks to accurately measure and classify market risk into three risk environments:

- Bull Market

- Uncertain Market

- Bear Market

Manage Market Risk

Systematically adjusts portfolio exposure in an effort to position the portfolio to:

- Profit in a Bull Market

- Protect in an Uncertain Market

- Profit or Protect in a Bear Market

Monitor

Smart Technology uses two price-based signals to accurately monitor current market risk. Smart Technology is not trying to predict the market’s next move, but rather measure current market risk with a high degree of confidence.

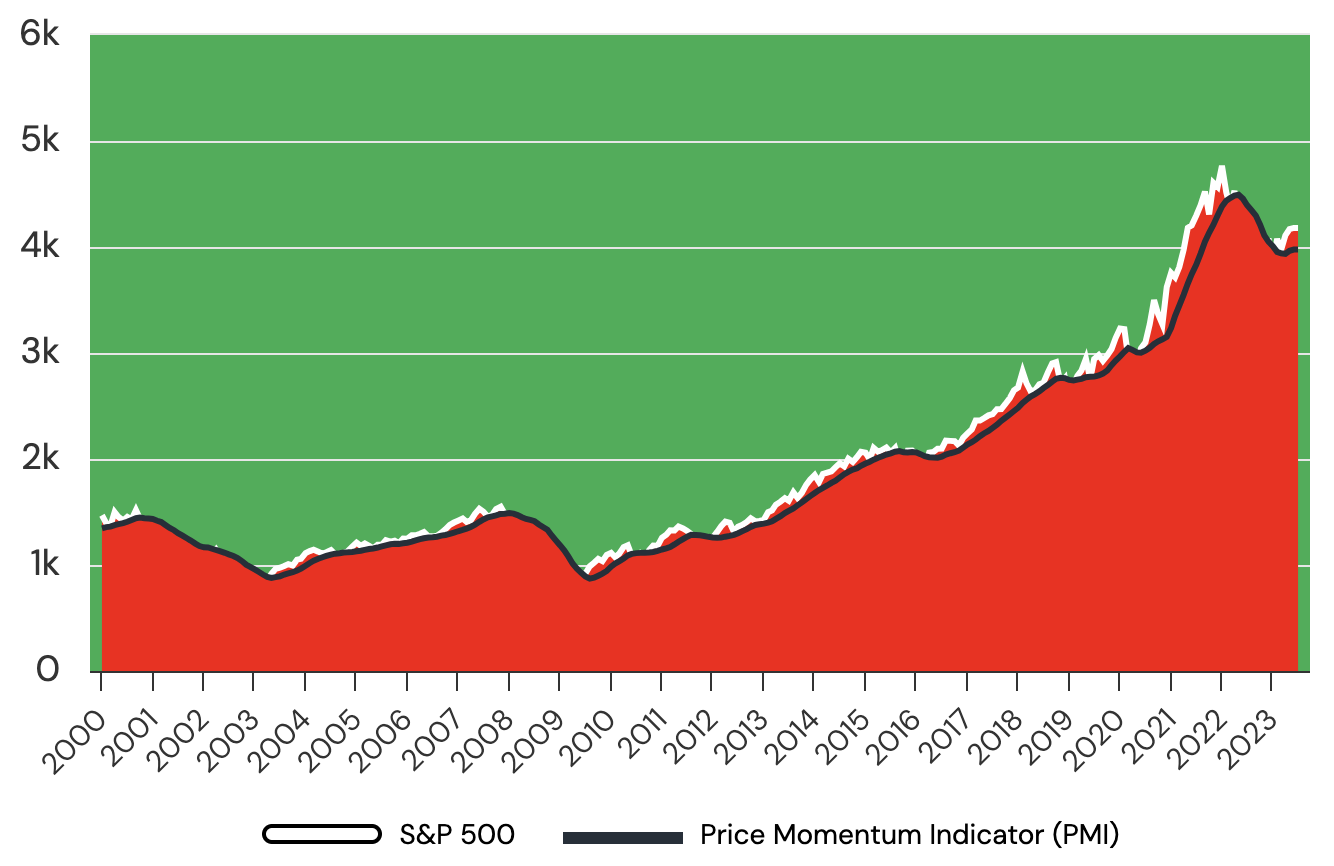

Price Momentum Indicator (“PMI”):

This trend following signal measures the price movement of the overall market using the 200 day simple moving average.

Market is Trending Up

Market is Trending Down

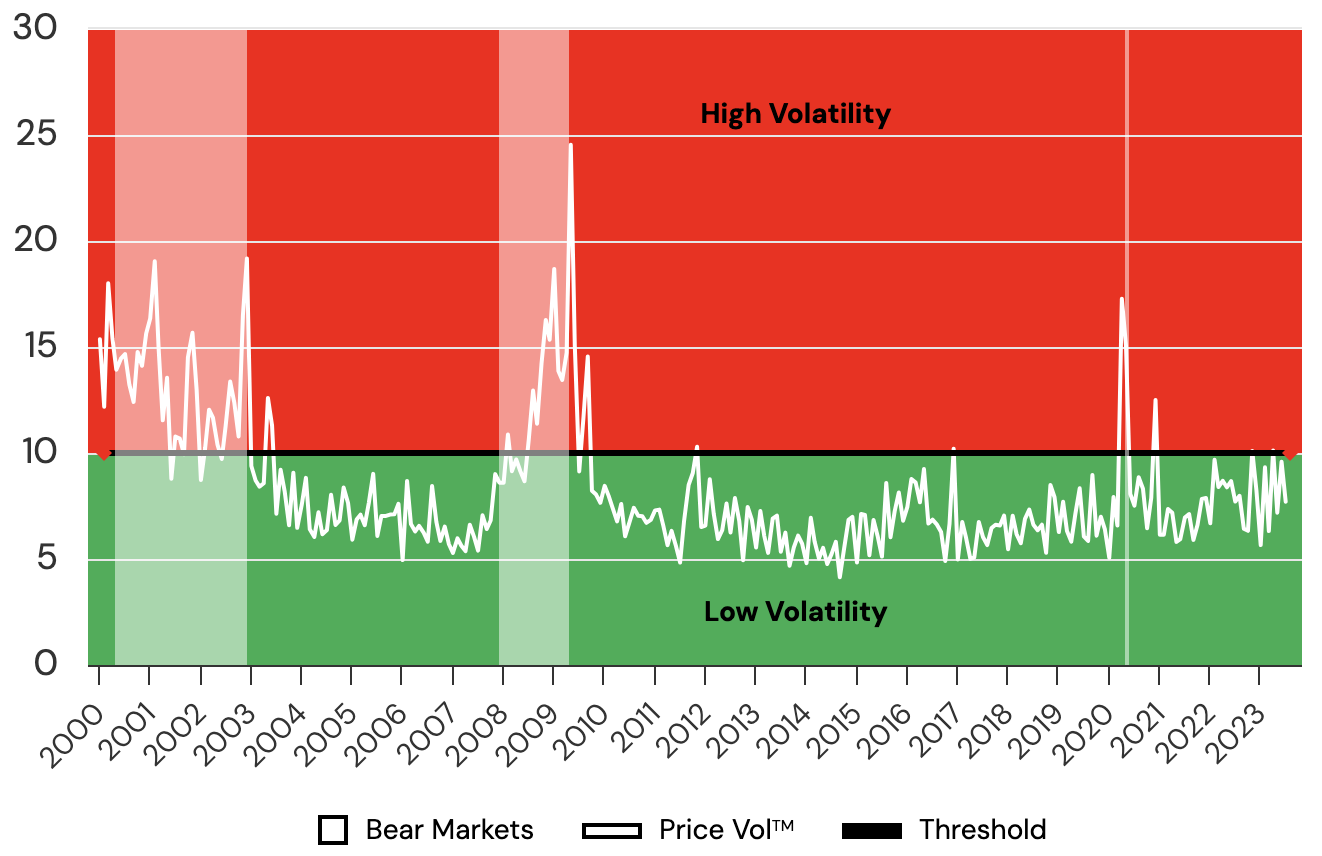

Price Volatility Indicator (“PVI”):

This volatility signal measures price movement of the individual securities of the market relative to the market using PriceVol™, a proprietary measure of realized volatility.

Realized Volatility is Low

Realized Volatility is High

Measure

PMI and PVI are combined to determine the market risk-environment. The two signals must agree to classify the market as either a bull or bear.

Manage

By systematically reducing portfolio exposure to the market as market risk rises, portfolio risk is decreased as market risk increases. Our portfolios are positioned to profit in a bull market, preserve capital in an uncertain market, and protect capital in a bear market.